FAssets Revolutionizes Non-Smart Contract Tokens: Introducing Utility Through the First-Ever Trustless Bridging Protocol

A new evolution to crypto blockchain.

In collaboration with Flare Networks, Flare Labs has developed a new and innovative bridge known as FAssets. This bridging model facilitates the integration of non-smart contract tokens such as (but not limited to) XRP, BTC, and DOGE onto Flare. It enables these tokens to utilize EVM-based smart contracts and participate in a decentralized economy securely and trustlessly. This inherently opens up new opportunities for interoperability and expanding the utility of non-smart contract tokens. Join me as I provide relevant updates on Flare, delve into the mission of FAssets, discuss data acquisition protocols, introduce key players in the FAssets ecosystem, and highlight various potential ways to earn.

Flare Updates:

Flare recently announced the initiation of private beta testing for FAssets on Flare's Coston testnet, aimed to be completed in Q1 of next year, which is just around the corner! Following the completion of testing on Coston, FAssets is set to launch on the advanced test network Songbird. After thorough testing, the protocol will make its debut on the mainnet, marking the beginning of an exciting phase in the world of DeFi.

Notably, CEO Hugo Philion has shared that the development of the protocols is on track and is aiming for all protocols to be launched between mid to end of 2024. Now, that’s a big statement. Hugo has faced criticism in the past for a perceived lack of communication. However, this expression from him indicates that the team is on the verge of a new evolution and is now prepared to transparently share their hard work with the community. Round-of-applause for Hugo; it’s not easy being a CEO.

Finally, Flare has revealed the addition of major professional infrastructure providers, including Ankr, Figment, Restake, Luganodes, and Northstake. These providers will serve a dual role of both network validators and data providers for the Flare Time Series Oracle (FTSO) system. This marks a significant progression in their business model, reflecting a commitment to Flare's mission.

This is indeed noteworthy EOY updates for the Flare community. It appears that there is lots to look forward to in 2024…

FAssets - The Why:

FAssets is among the first bridging solutions for non-smart contract chains that provide utility in a decentralized manner, ensuring that the bridging process is not reliant on a centralized authority. Instead, it operates through a set of validators who listen to asset deposits and execute the creation of corresponding assets on the Flare Network. This approach enhances security, trustlessness, and censorship resistance in the bridging process.

Flare has identified that over 70% of blockchain assets lack smart contract capabilities and are locked away in siloed blockchains, hindering their participation in the decentralized economy.

By minting these non-smart contract tokens into FAssets, users not only enhance the utility of their non-smart contracts, enabling various use cases such as bridging, lending, borrowing, metaverse, trading, DeFi, NFTs, and payments, but they also earn $FLR rewards for native network participation.

Data acquisition protocols that drive the FAsset system:

The FAssets system operates through Flare Network's inherent data acquisition protocols, namely the State Connector and the FTSO. In simple terms, Flare’s data acquisition protocols function to securely and trustlessly obtain external data and integrate it into the native network. Consequently, these protocols are crucial for the smooth functioning of the FAsset system.

“Flare isn't just another EVM chain. We're on a mission to expand blockchain possibilities by providing protocols that optimize data and data proof acquisition.”

In the FAsset system, the State Connector plays a vital role as a decentralized intermediary, securely bridging data from external blockchains onto Flare. This is achieved through the use of independent attestation providers, which fetch off-chain data and integrate to the native network. This includes essential data related to transactions or events on connected chains.

For instance, the State Connector can securely prove specific events with a binary answer, like the minting, burning, locking, or redeeming of FAssets on the external blockchain. This capability ensures that the FAsset system can accurately track and verify the status of assets on other chains, providing users assurance necessary for seamless interaction with FAssets.

Contrastingly, the FTSO protocol focuses on sourcing decentralized high-integrity time series data, such as digital asset price pairs, from an independent network of data providers. The current time-series data frequency operates at 3minute intervals. However, with the imminent release of FTSO V2 in early Q1, there is an expected transition to 90-second intervals, ensuring a more timely and current representation of information.

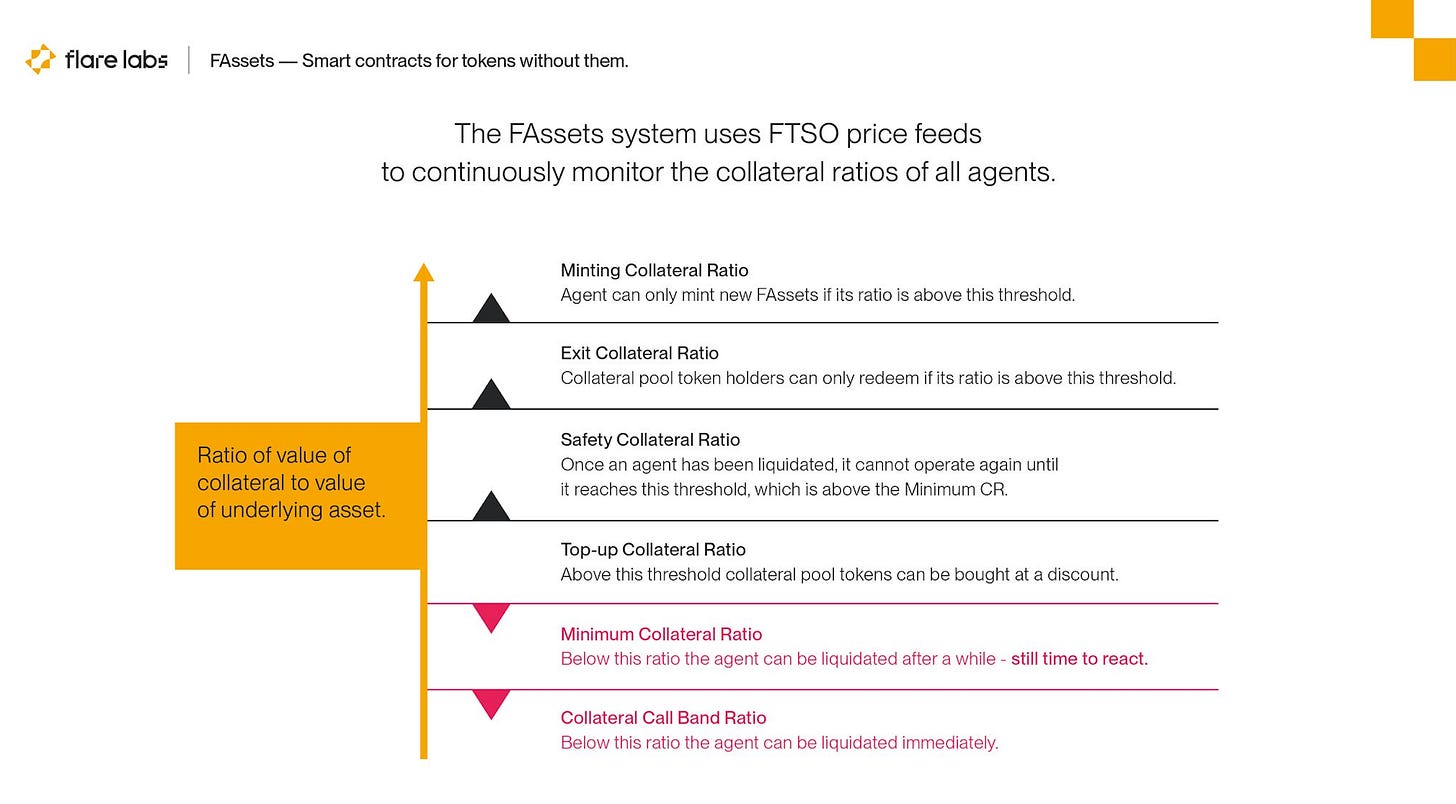

The data acquired by the FTSO providers holds paramount importance for various use cases, including the valuation, trading, and collateralization of FAssets. For instance, the FAsset system relies on FTSO price feeds to continually monitor the collateral ratios of all agents.

The image below obtained by Flare Labs, illustrates the status of healthy vs. unhealthy collateral ratios in the FAsset system, through utilising the FTSO price feeds.

Still don’t understand what’s going on? Don’t worry, this leads to a discussion about the key player roles in the FAsset system and should help bring everything full circle.

Key Players in the FAsset System:

We already know who the main players are in the FAsset system, so lets not repeat what's already accessible. Instead, let's break down their roles in simple format, and add some spice to it.

Minters/Redeemers:

The minter is the customer of the FAssets system.

The minter selects an agent, based on variables such as their minting fees, collateral ratio, liquidations score, or total collateral in vault. Once chosen, the minter then pays a fee to reserve collateral.

The minter initiates the minting process by sending the underlying asset e.g. XRP to the selected agent within a set time period. The State connector verifies this before the minter would receive their freshly minted FAsset, FXRP.

The FAsset system utilises the FTSO to monitor collateral ratio and checks for sufficient collateral of the agent.

If the ratio and collateral requirements are met, the FAsset smart contract mints the requested amount of FAssets and transfers them to the minter's designated address.

The same minter can also be a redeemer if they choose to return their FAssets and claim the underlying tokens they represent by submitting a ‘redemption request’.

This request includes the amount of FAssets you wish to redeem.

The FAsset smart contract verifies the availability of the requested FAssets and initiates the transfer of the corresponding collateral back to the minter.

Agents:

Agents facilitate the minting and redemption of FAssets.

Agents have two forms of collateral: vault collateral and pool collateral.

The agents will have diverse collateral options, including FLR/$SGB, stable coins, and ETH, all maintained at a collateralization ratio of 200% or higher relative to the underlying asset value.

The agent checks the compliance of the request with the system's rules, verifying the collateral ratio, and ensure the availability of sufficient collateral.

If the request is valid, agents interact with the FAsset smart contracts to execute and finalize the minting or redeeming process.

How agents are incentivized:

Creation Fee and Redemption Fee: Agents receive a fee as a percentage of the transaction size for their involvement in minting new FAssets or facilitating in redeeming FAssets.

Collateral Reservation Fee: As mentioned earlier, minters pay agents a collateral reservation fee when initiating the creation of an FAsset.

Transaction Fees: Agents may also earn transaction fees for facilitating transactions within the FAsset system through various tasks, such as validating transactions or executing smart contracts.

Liquidators:

When an agent's collateralization ratio falls below the required threshold, the liquidator initiates the “liquidation mode”. Liquidators spring into action redeeming FAssets with the agent in order to bring the agent’s collateral ratio back into balance.

How is this achieved? First, the liquidator needs to acquire assets, either by buying them off the market or DEX, or by self-minting. Then, they redeem the FAsset from the agent at a discounted price, freeing up the agent's collateral ratio. However, it's worth noting that the agent might have to pay a penalty here. The next step is burning the liquidator's FAsset upon redemption, and a premium is paid out and removed until the agent's pool and vault achieve a safe collateral ratio again. The premium could be a percentage, serving as a penalty because the agent could have topped up their collateral earlier but didn't, leading themselves to liquidation mode.

When an agent undergoes liquidation, it indicates that their collateral is inadequate to sustain the minted FAssets.

Liquidation poses a risk solely for the agent, as they are required to purchase the FAssets using their collateral at a slightly higher price than the FTSO.

The liquidators are incentivized, most likely through the mechanism of earning Flare’s native tokens.

Challengers:

Challengers play a crucial role in maintaining the integrity of the FAsset system by ensuring that agents adhere to the specified rules and hold the required underlying collateral.

When a challenger identifies potential misconduct such as an agent failing to hold the underlying assets, they can initiate a challenge.

How do challengers identify unauthorized transactions? They utilize the State Connector for this purpose, supplying evidence to the protocol as validation. With this proof, the Agent will be disabled from minting, and their backed FAssets will be subjected to liquidation.

When a challenger successfully identifies and reports a legitimate issue, they may receive rewards in the form of native tokens.

Earning Potential:

Flare's Cross-Chain Incentive (CCI) pool, which holds 20 billion FLR, is a component of their tokenomics designed to incentivise liquidity from different blockchains to be bridged to Flare through FAssets (/LayerCake). When users mint an FAsset, they receive CCI rewards, making them eligible to participate in the native network, such as monthly FlareDrops and governance.

Additionally in Staking Phase 3, Flare aims to give P-chain staked funds the same rights as wrapped FLR on the C-chain. This means users will earn by wrapping and delegating their new $FLR for FTSO delegation rewards. Simultaneously, they can secure the network by staking with network validators to earn staking rewards. This creates an ongoing compounding effect.

In the FAssets system, the secondary Agent Community Collateral Pool allows users to deposit $FLR, enabling them to earn a portion of the agent fees. The fees could be potentially paid in FAssets or in Flare's native token; further details are pending. The community-provided collateral aims to enhance the agents' vault collateral.

Additionally, this collateral plays a crucial role in supporting the assets minted on the network, promoting efficient cross-chain transactions and interoperability. While this may be appealing to those seeking to compound their rewards, it's essential to be aware of potential risks associated with depositing into an agent that undergoes liquidation, although the specifics of such risks are yet to be defined.

Moreover, offering increased flexibility, FAssets can be seamlessly bridged to other networks through LayerCake (an insured-in-transit bridging and cross-network composability protocol for smart-contract chains) once they are integrated into Flare.

Finally, a little Christmas present from me to everyone in the Flare community… 🎁

I went ahead and mapped the current earning opportunities on Flare and the potential earnings with the upcoming rollout of FAssets. Disclaimer: This video was created in a free-style format, and certain details may not be confirmed but are worth noting. It is important to emphasize that this content is not financial advice; rather, it is intended solely for educational purposes.

Remember we're still in the early stages, giving you the opportunity to participate, learn, and take advantage of this expanding network. The future of Flare is promising. ☀️

To learn more: